This content is for Premium Subscribers only. To view this content, login below or subscribe as a Premium Subscriber.

Related News Articles

Why Private Sector Partnership Is the Key to South Africa’s Rail Revival

05 February 2026

SADC, South Africa

6 min

South Africa: Third Progress Report on Operation Vulindlela, Rail Sector Update

04 February 2026

SADC, South Africa

2 min

Four GL30 Locomotives Set to Boost Camrail Operations

03 February 2026

West Africa, Côte d’Ivoire

1 min

Floods Disrupt Regional Rail Links Between Mozambique

23 January 2026

SADC, Zimbabwe

2 min

Transnet Sustains Improved Performance to Set the Path for Growth

18 December 2025

SADC, South Africa

2 min

South Africa’s Largest Private Rail Investment Begins with Forty-Six Locomotives

12 December 2025

SADC, South Africa

1 min

Transnet and ICTSI Seal Partnership for DCT Pier 2

10 December 2025

SADC, South Africa

1 min

Traxtion Confirms R3.4bn Rolling Stock Investment to Unlock Rail Capacity and Jobs

05 December 2025

SADC, South Africa

4 min

Transnet Opens Registration of Interest for Northern Cape Iron Ore Export Capacity

05 December 2025

SADC, South Africa

1 min

EIT Group’s Estcourt Intermodal Freight Village Due for Expansion

05 December 2025

SADC, South Africa

3 min

South Africa: TRIM Opens Submissions for Ad-hoc Train Path Applications

05 December 2025

SADC, South Africa

1 min

UNTU Condemns PRASA’s Section 189A Restructuring and warns of Over 500 Job Losses

28 November 2025

SADC, South Africa

1 min

Durban–Gauteng Logistics Corridor to Receive Major Boost from Private Investors

21 November 2025

SADC, South Africa

4 min

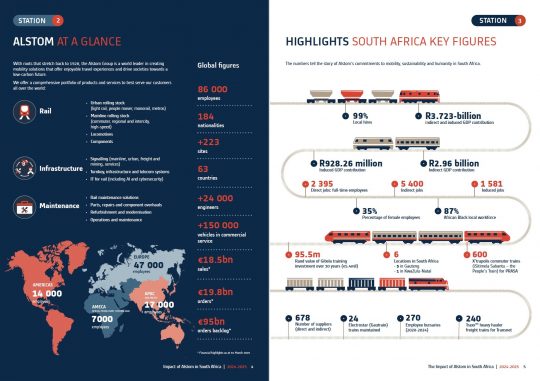

Alstom Impact Report Reaffirms Deep Commitment to South Africa

21 November 2025

SADC, South Africa

3 min

Advancing Urban Mobility: SAICE’s Perspective on Integrated Public Transport in SA

14 November 2025

SADC, South Africa

5 min